Good morning. Last week, The Ministry of Health lost Ksh 5.3 billion that was meant to finance the fight against Covid-19, HIV, tuberculosis and malaria due to lack of capacity to use the funds.

Safaricom and Visa have launched MPESA Global virtual card

The M-PESA GlobalPay Visa Virtual Card will be exclusive for international, online payments outside the country to protect customers from incurring forex conversion costs on local online payments billed in Kenya Shillings.

The launch of the new M-PESA Visa virtual card opens global shopping for Kenyan consumers, allowing secure cashless payments at more than 100 million merchants in over 200 countries through Visa’s global network.

more details

Transactions using the card will be subject to Mpesa limits of 150,000 and double that per day.

The virtual card will later be introduced in Tanzania, DR Congo, Mozambique, Lesotho, and Ghana.

NATIONAL DEBT

The National Treasury proposed an increase in the debt ceiling to Ksh 10 Trillion

Last week, The National Treasury proposed increasing the debt ceiling from the current Ksh 9 Trillion to Ksh10 Trillion.

This will enable the Government borrow more inorder to finance the Ksh 3.33 Trillion budget for the 2022/23 financial year.

The debt limit allows Kenya to continue accessing concessional funding from multi-lateral and bi-lateral agencies to finance inclusive economic growth and development programs.

Treasury Cabinet Secretary Ukur Yattani urged Members of Parliament to amend the Public Finance Management(national government) Regulations, 2015, so as to increase the limit.

ECONOMY

1. Only 1.6 million of Kenya’s 66 million bank accounts hold more than Ksh 100,0000

The Central Bank of Kenya (CBK) released data showing that only 1.6 million of Kenya’s 66 million bank accounts held more than Ksh 100,0000.

Reason for this?: Layoffs, job cuts, and closure of small businesses due to the coronavirus-induced slump wcut the number of bank accounts that held more than Ksh100,000.

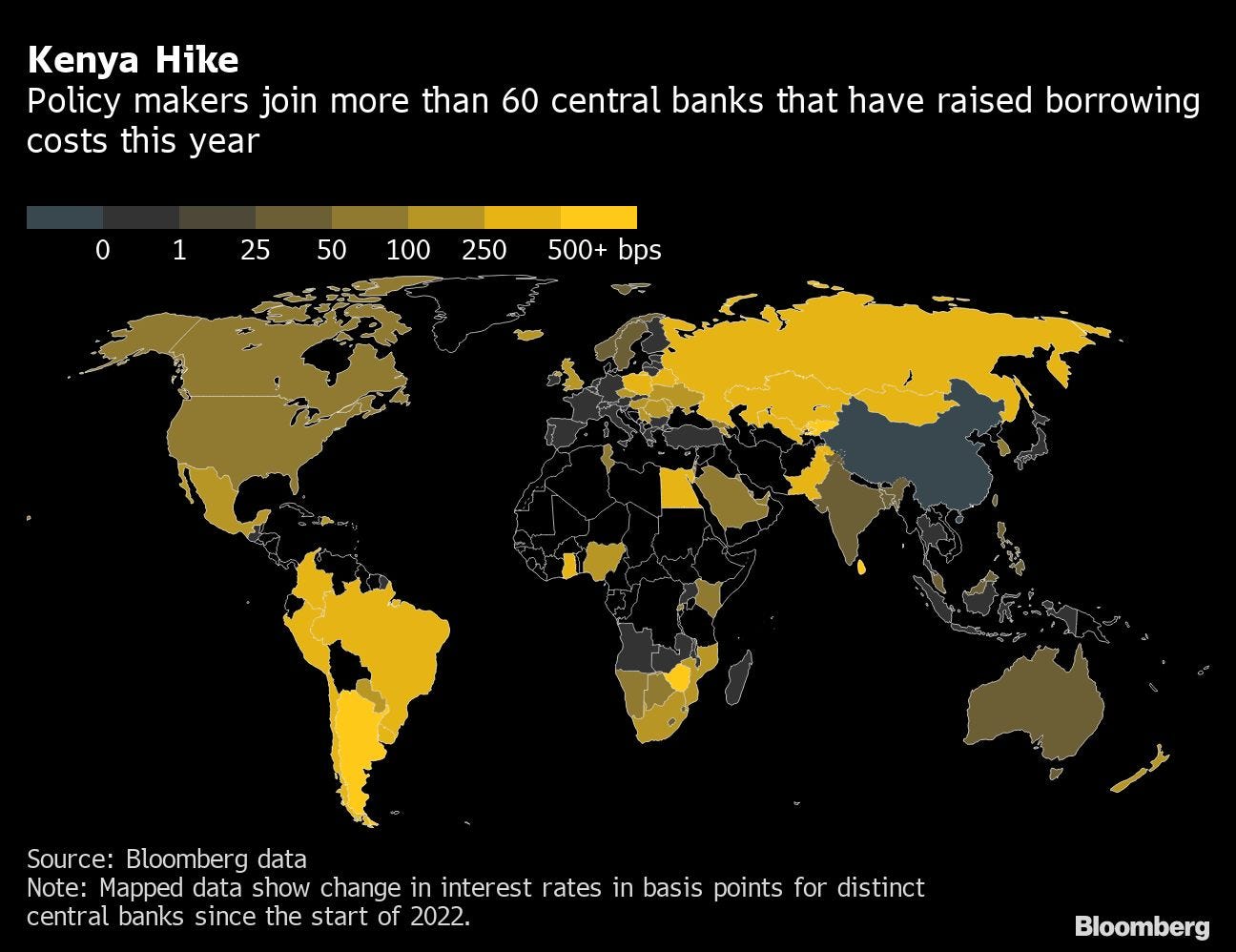

2. Kenya's Central Bank Hiked Key Interest Rate for the first time in 7 Years.

Kenya’s Central Bank unexpectedly raised its key interest rate for the first time in almost seven years to anchor inflation expectations as concerns about commodity prices went up.

The monetary policy committee increased the rate by 50 basis points to 7.5%,

“The decision was taken because of elevated risks to the inflation outlook due to increased global commodity prices and supply chain disruptions” - CBK Governor Patrick Njoroge

ENVIRONMENT

NEMA re-introduced the Environmental Impact Assessment (IEA) fees

The National Environment Management Authority (NEMA) has re-introduced the Environmental Impact Assessment (EIA) fees and other related fees.

The IEA processing and monitoring fee will be 0.1% of the total project cost to a minimum of Ksh 10k.Background: In October 2016, The government authorized the suspension of EIA fees, which was the main revenue source for NEMA.

The re-introduction of the fees means that putting up a real estate project, road or any other major facility in Kenya will cost more.

For example: a developer putting up a Ksh100 million project will pay Sh100,000 as IEA processing and monitoring fees.

Reactions: The Architectural Association of Kenya (AAK) has also called on the government to re-think the re-introduction of the fee.

INSOLVENCY

English Point Marina has been seized by KCB bank

KCB seized Mombasa’s luxury property English Point Marina & placed Pearl Beach Hotels, the real estate firm that owns it, under statutory management over a Ksh 5.2 Billion debt.

The property developer of English Point Marina has been in conflict with buyers who claim they have not taken ownership of the houses they bought at a cost of Ksh 600 million.

The receiver-manager is expected to sell part of or all of the property inorder with to raise funds to settle the amounts owed to KCB.

KCB’s claim takes priority over the other creditors who will have to wait for the bank’s claims to be paid.

Note: Lenders are still allowed to appoint receiver managers in loan contracts that existed before the commencement of the Insolvency Act of 2015.

WHAT YOU MUST HAVE MISSED LAST WEEK

Kenya Power to reduce electricity bills by 15%

The National Treasury issued a Ksh 7.05 billion subsidy to KPLC to allow it cut electricity bills by a further 15%. The Budget Committee of the National Assembly revealed that the subsidy will shield the company from the effects of reducing electricity bills by a further 15%.

Tax on Liquified Petroleum Gas to be reduced

Members of Parliament approved a proposal to reduce the tax on LPG from the current 16% to 8%.

Russia plans to resume wheat exports, which could lower the price of wheat locally

About 66% of wheat that Kenya imports comes from Russia and Ukraine. The current blockade has seen the price of a 400g loaf of bread rise to Ksh 55 from Ksh 50 with a two-kilogramme packet of flour retailing at Ksh 202 from Ksh150 in April.

Foreign investor outflows at the Nairobi Securities Exchange hit Ksh 4.2Billion in May 2022

Foreign investors withdrew a net of Ksh 4.2 billion from the Nairobi Securities Exchange (NSE) last month, continuing the flight to western markets where interest rates have risen sharply in the last few months.

Are you an avocado farmer ?

The government successfully negotiated a deal for avocado exports to China and India. Kenya exported 85 million Kgs of the produce in 2021 worth Ksh 14.4 Billion.