Good Morning. In the latest fuel prices review, fuel prices will remain unchanged. Consumers in Nairobi will continue to pay Ksh129.72 for a litre of petrol, Ksh 110.6 for diesel and Ksh103.54 for kerosene.

Summary of last week’s Foreign exchange rates

Nationwide Power Blackouts

Most Kenyans now have their lights back on after a week with 3 nationwide power blackouts. The blackouts were as a result of three major transmission failures occurring within hours of each other.

The first incident happened on Monday night and was resolved quietly.

The second major failure was on Tuesday at 10.45 am.

The third failure happened on Tuesday after 5 pm and was solved hours later.

The Tuesday mid-morning outage happened after towers supporting a high-voltage power line linking Nairobi to the Kiambere hydroelectric dam collapsed. The amount of losses incurred by businesses and households remain unknown. However, the numbers must be astronomical.

Should KPLC (Kenya Power and Lighting Company) compensate for losses ?

Currently, KPLC only compensates for injuries and damaged kits but does not pay for financial loss as a result of power blackouts.

However, the Energy and Petroleum Regulatory Authority is advocating for regulations that will make Kenya adopt a compensation model which requires KPLC to compensate users whose homes and businesses are cut off power for prolonged periods of time.

CAPITAL MARKETS

1. Kenya Mortgage Refinance Company (KMRC) to issue its first corporate bond

KMRC is targeting to raise an initial Ksh 1.4 billion in its bond issuance as it targets a total of Ksh 10.5 billion for onward lending to financial institutions. The Capital Markets Authority has already approved KMRC’s roll out of the medium term note.

Note: The KMRC bond will be listed at the Nairobi Securities Exchange. However, There is still no update as to the date of the first tranche issuance.

2. Bill published aiming to compel SACCOS to share credit information

The government has republished the Sacco Societies (Amendment) Bill with the aim of compelling Savings and Credit Co-operative Societies (saccos) to share information with credit reference bureaus (CRBs).

The bill converges credit information-sharing of SACCO’s, Banks and Micro-finance institutions under a single regulatory framework.

what happens currently:

According to the CRB Regulations 2013, Saccos need to seek prior approval from the Central Bank of Kenya (CBK) and obtain consent from their customers before sharing credit information.

looking forward:

If the bill is enacted into law, SACCO’s will be mandated to share both positive and negative information of their customers with licensed CRBs.

3. Capital Markets Authority grants HotForex license as an online foreign exchange broker

HF Markets Group announced on Wednesday that HotForex is now licensed and regulated by the Capital Markets Authority (CMA) of Kenya as a non dealing online foreign exchange broker.

HotForex is an internationally acclaimed multi-asset broker with over 2.5 million live accounts worldwide.

COVID-19 AND TRAVEL

1. United States warns citizens against travelling to Kenya

The United States has downgraded Kenya from level 1 to a level 3 travel advisory.

What does this mean - all American citizens have been advised to avoid all non-essential travel to Kenya or reconsider planned trips to the country.

The Level 3 category applies to destinations that have had between 100 and 500 cases per 100,000 residents in the past 28 days.

2. Kenya suspends all passenger flights from Dubai for 7 days

Kenya has suspended all inbound and transit passenger flights from the United Arabs Emirates (UAE) to retaliate a move by Dubai to ban all passenger flights from Kenya over fake Covid tests.

Note: The ban does not affect cargo flights that are normally flown by carriers such as Kenya Airways and Emirates airline from UEA into Kenya.

COURT DECISIONS

1. High Court suspends the increase of motor vehicle insurance premiums

Background : The Kenya National Human Rights Commission (KNHRC) filed a petition in court seeking to have the decision by insurance companies to increase motor vehicle insurance premiums struck out.

KNHRC states that the decision is illegal, discriminatory, and unjustified because there was no public participation.

High Court: Last week, the court suspended the increase of motor vehicle insurance premiums pending determination of the case.

The court also suspended the firms’ decision to deny comprehensive insurance cover for motor vehicles that are older than 12 years or with a value of less than ksh 600,000.

2. High court suspends law requiring advocates to be reporting persons under the Proceeds of Crime and Cybercrimes act

Section 2 (c)(i) and section 14 (b) of the Proceeds of Crime and Anti-Money Laundering (Amendment) Act have been temporarily suspended by the HighCourt pending determination of a suit.

Background:

(click and read 3rd section)

Petitioners’ claims:

The sections violate the principle of advocate-client privilege contained in the Advocates act thereby impeding the advocates’ duties and service delivery to their clients.

The existence of the aforementioned sections means that advocates will be at risk of breaching either the Proceeds of Crime and Anti-Money Laundering (Amendment) Act or The Advocates act:

Advocates would breach provisions of the Proceeds of Crime and Anti-Money Laundering (Amendment) Act if they assert advocate-client privilege and fail to report their clients’ transactions to the Financial reporting centre.

They would breach the Advocates Act if they abide by the recent amendment and report their clients’ transactions to the Financial Reporting centre.

TAX

Kenya Revenue Authority adopts mapping technology to monitor the tax compliance of Landlords

The Kenya Revenue Authority is implementing a block management system that will use geographic information system (GIS) to map out buildings in various residences. The system will be used to monitor the tax compliance of landlords.

How the system will work:

It will classify various estates into blocks of flats where the KRA will identify the landlords who are tax-compliant and those who are not.

It will also detect new buildings springing up.

The system will first be implemented in the towns of Nairobi and Mombasa.

what tax obligations do landlords have?

a. Landlords with annual rental income of between Ksh288,000 (Ksh24,000 per month) and Ksh15 million (Ksh1.25 million per month) are required to file a monthly tax return declaring the gross earnings rent from which tax payable is computed at 10% of the gross.

b. Property owners with monthly rental income of less than Ksh24,000 or more than Ksh1.25 million are to declare such earnings together with other revenue sources when filing annual income tax returns. - Section 6A of Income Tax Act

MUST KNOW CONVERSATIONSTARTERS

Insurers fined by the Insurance Regulatory Authority for late payment of claims-

The Insurance Regulatory Authority annual report revealed that 9 insurers have been fined Ksh 17.6 million for late payment of claims, failure to submit audited accounts & failure to submit premium levy payment.

Delayed payment of claims: Invesco Assurance fined Ksh 7.9 million, Keninidia Assurance - Ksh 1.0 million, KUSSCO - Ksh 161,739 and Kenya Alliance - Ksh 51,547.

Failure to pay the premium levy: Resolution Insurance -Ksh 3.2 million and Explico Insurance- Ksh 510,000.

Late audit submissions: Metropolitan Cannon fined Ksh 1.3 million, Takaful Insurance- Ksh 330,000 and Trident - Ksh 3 million.

Car and General (C&G) plans to go fully electric - C&G intends to start selling electric vehicles and tuk-tuks as part of a plan to diversify into the ‘green’ mobility business.

C&G has been selling motorcycles and three-wheelers with internal combustion engines. However, it announced that it intends to launch electric three-wheelers next month.

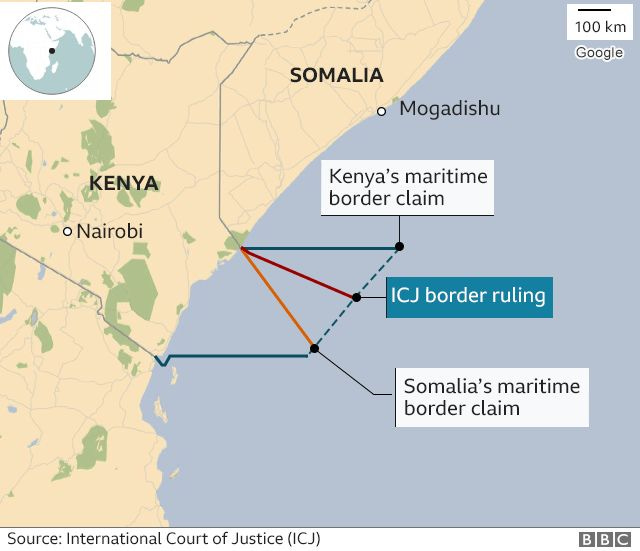

Kenya increases Oil and Gas exploration activities in the Lamu Basin - Kenya is still exploring oil and gas in the Lamu Basin even after the controversial ICJ ruling on the delimination of Kenya-somalia maritime border.

Equity to offer Life Insurance - On January 10th 2022, Equity Group obtained the registration and license of Equity Life Assurance (Kenya) Limited as an insurer from the Insurance Regulatory Authority(IRA).

Enjoyed this week’s ConversationStarter?