Happy New Week

New Minimum Contribution to NSSF Raised Starting this Month

Last week, judges Hannah Okwengu, Mohamed Warsame, and John Mativo ruled that the National Social Security Fund (NSSF) Act of 2013, which sought to increase workers' monthly contributions, is legal and that the government can implement it.

“We find that the Employment and Labour Relations Court (ELRC) made a mistake in declaring the Act unconstitutional when it had no jurisdiction to question validity of the law as that was a preserve of the High Court”- Court of Appeal.

After the Ruling, National Social Security Fund (NSSF) announced that the minimum monthly contribution had been raised starting this month.

How this affects workers

The NSSF Act, 2013 increased salaried employees’ monthly deductions from Ksh 200 to Ksh 600 for the lowest earner and from Ksh 320 to Ksh 1,080 for top earners. The upper limits on contributions are set to rise every year.

"We understand that this increase may cause some inconvenience for our members, but we assure them that this is for their own good. This change will help us provide better benefits to our members in the future," - NSSF Managing Director, Nelson Gaichuhie.

TAX

1. National Treasury gazetted the Income Tax (Financial Derivatives) Regulations 2022.

The gazettement allows KRA to begin collecting taxes on financial derivatives following amendments brought about by the Finance Act 2022.

The Finance Act 2022 amended Section 3(2) of the Income Tax Act, Cap 470) to introduce a 15% withholding tax on income from financial derivatives contracts earned by a non-resident person.

what falls within the ambit of derivatives whose gains will be deemed taxable?

Call options, Currency swaps, Forward contracts, Futures contracts, interest rate swaps, Options contracts, Option premiums, Put option

Highlights of the Income Tax (Financial Derivatives) Regulations 2022

The regulations provide that any gain realized from a financial derivative will be taxed at 15.0% (of the gain).

The word 'gain' is defined as profit earned by a person from a financial derivative contract including any premium or fee.

The regulations provide that any gains from financial derivatives will be deemed to be a separate source of income.

What is the effective date?

The Finance Act 2022 provided Jan 1st, 2023 as the effective date whereas the Gazette notice is dated Jan 27th, 2023.

2. Mystery Surrounds Missing Chinese Imports Worth Billions in Kenya

Chinese imports valued at Ksh 431.9 billion for the first 10 months of last year are missing from official data reported by the Kenya Revenue Authority (KRA), raising concerns over the scale of tax evaded.

An analysis of official trade data published separately by the two countries' tax authorities has revealed a wide disparity in the value of imports from the Asian economic giant.

Official KRA data, as published by the Kenya National Bureau of Statistics (KNBS), placed the value of imports from China at Ksh 377.5 billion in the review period.

However, According to the General Administration of Customs of the People’s Republic of China (GACC) website, which is the equivalent of KRA, the goods exported from China to Kenya during this period were valued at Ksh 809.4 billion.

JUDICIARY

Tribunal Recommended the removal of Justice Said Chitembwe from office as Judge

A 12-member tribunal ruled in a 262-page report that Justice Chitembwe’s conduct was unbecoming of a judge in contravention of Articles 73 of the constitution as well as the code of conduct and ethics.

The tribunal chaired by Court of Appeal judge Mumbi Ngugi found that six allegations against Justice Chitembwe were proved, among them advising litigants to withdraw a case that was pending in court and advising former Nairobi governor Mike Sonko to challenge his ouster.

The Tribunal’s Recommendation to the President was as follows: Your Excellency, having considered all the evidence and following the Tribunal’s findings that Allegations have been proved,we unanimously find that the Judge’s conduct was in breach of the Judicial Service Code of Conduct and Ethics Regulations 2020 and amounted to gross misconduct contrary to Article168(1)(b) and (e) of the Constitution.

In accordance with Article 168(7)(b) of the Constitution, we, therefore, recommend to Your Excellency that the Honourable Mr. Justice Said Juma Chitembwe be removed from the office of Judge of the High Court.

What are the grounds for the removal of a Judge of the High Court?

The Grounds are set out in article 168 of the Constitution of Kenya and include:

Inability to perform the functions of office arising from mental or physical incapacity.

Breach of a code of conduct prescribed for judges.

Bankruptcy.

Incompetence

Gross misconduct or misbehavior.

Access the full Report Here

ECONOMY

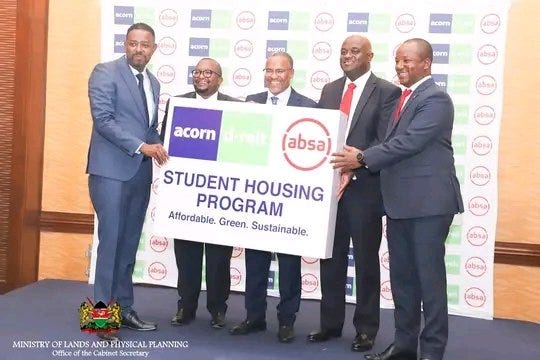

Absa and Acorn Africa announced a Ksh 6.7 Billion affordable housing partnership

Rental housing developer Acorn Holdings Limited together with Absa Group and Absa Bank Kenya, announced the successful conclusion of a Ksh 6.7 Billion financing agreement to support the development of a further ten purpose-built student accommodation developments in Nairobi, Kenya.

The partnership aims to build 10 new, purpose-built, ESG-friendly student accommodations in Nairobi with a capacity of ~12,000 student beds.

Acorn will be developing the student accommodation housing units over the next 3 years, therefore adding another 12,000 beds to the Acorn Student Accommodation REITs, bringing the total bed portfolio to 21,000 beds.

Speaking at the function, State Department for Investments Promotion Principal Secretary, Abubakar Hassan, encouraged greater participation of pension schemes for the affordable housing agenda to bolster funding for the initiative.

CAPITAL MARKETS

Centum Opened 66.5 Million Shares Buyback Program

Centum Investment started a 66.5 million share repurchase program on Monday last week, to stabilize the Company’s market value and stock price.

The Company allocated Ksh 600.8 million for the buyback program. On Friday, the Company’s shares ended trading at Ksh 8.74.

The buyback program will run for 18 months (starting from the date of the resolution by the company) and will end on August 8, 2024.

All shareholders are eligible to participate.

However, the Company’s buyback limit is restricted to 10% of its ordinary shares.

By remaining as shareholders, they stand to benefit from an increase in the company’s future earnings and capital gains.

WHAT YOU MIGHT HAVE MISSED

World Bank pledged to Boost Hustler Fund with Technical and Financial Support

President William Ruto announced that he welcomed World Bank’s move to support the Hustler Fund in cushioning the vulnerable in society. The announcement was made after President Willian Ruto held a meeting at Statehouse with a delegation from World Bank on Tuesday.

Susan Koech was selected as the second deputy governor of the Central Bank of Kenya (CBK)

President William Ruto selected former Wildlife PS Susan Koech as the second deputy governor of the Central Bank of Kenya (CBK). The appointment of the second CBK governor aims at avoiding a leadership vacuum at the CBK in June when Governor Patrick Njoroge and his sole assistant Sheila M’Mbijjewe will end their last term after serving the maximum of eight years.

Dr. Koech is expected to face tough questions in Parliament over tenders for the construction of the Kimwarer and Arror dams, where she was initially charged with corruption before being turned into a State witness.

Solar supply to the power grid increased

The amount of solar supplied to the national grid in the nine months to September 2022 increased by 184% to a four-year high, boosting Kenya’s commitment to run on a 100% clean energy network by 2030.