Happy new week!

Kenya to import 30% of its fuel on credit from the UAE starting April

From next month, Kenya will start importing fuel on credit (of up to one year) from the United Arab Emirates to ease pressure on dollar demand.

Energy and Petroleum Cabinet Secretary Davies Chirchir stated that the government-to-government deal would see Kenya import 30% of its monthly fuel requirements through the State-owned National Oil Corporation (Nock).

The imports are expected to ease a crisis in the foreign exchange market given that oil shipments account for 28% of Kenya’s monthly imports.

Pump prices have remained unchanged since November, with a litre of super petrol retailing at Ksh177.30 and diesel at Ksh 162 per litre - up from Ksh106.99 and Ksh 96.40 respectively in February 2021-

How will this affect the market?

Some state officials raised concerns that the longer credit line could wipe out the benefits of buying diesel and petrol in large quantities.

In response to that, Daniel Kiptoo, the director-general of the Energy and Petroleum Regulatory Authority (Epra) stated,

“We will only know for sure (the effect on pump prices) oce the bids are opened and evaluated,” - excerpt from the Business Daily.

CAPITAL MARKETS

NSE extended the tenure of its Chief Executive Officer Geoffrey Odundo by another year

The Nairobi Securities Exchange extended the tenure of its Chief Executive Officer Geoffrey Odundo by another year. He was set to leave the firm upon completing his second four-year term on February 28.

Mr. Odundo assumed the NSE leadership on March 1, 2015, during the onset of a prolonged bear market that has adversely affected the performance of the company, which earns fees on transactions.

The NSE stated that the decision was made in light of the government’s short-term plan to list five State-owned firms on the stock exchange.

For years, there hasn’t been a significant new listing in the NSE, causing Safaricom, banks, and a few manufacturers to dominate the bourse in terms of profitability, dividends, and market capitalization.

MERGERS AND ACQUISITIONS

Premier Bank Somalia receives approval from Competition Authority to acquire a stake in First Community Bank

Premier Bank Limited (Somalia) received approval from the Competition Authority of Kenya (CAK) to acquire a 62.5% stake in FCB (First Community Bank).

The value of the deal is yet to be made public.

According to Business Daily, the acquisition will help support FCB, whose core capital had dropped to Sh924 million against the required minimum of Sh1 billion.

The reduced capital left FCB’s core capital to total risk-weighted assets ratio at 7.1% compared to the required minimum of 10.5%

The deal now awaits approval from the Central Bank of Kenya (CBK)

TAX

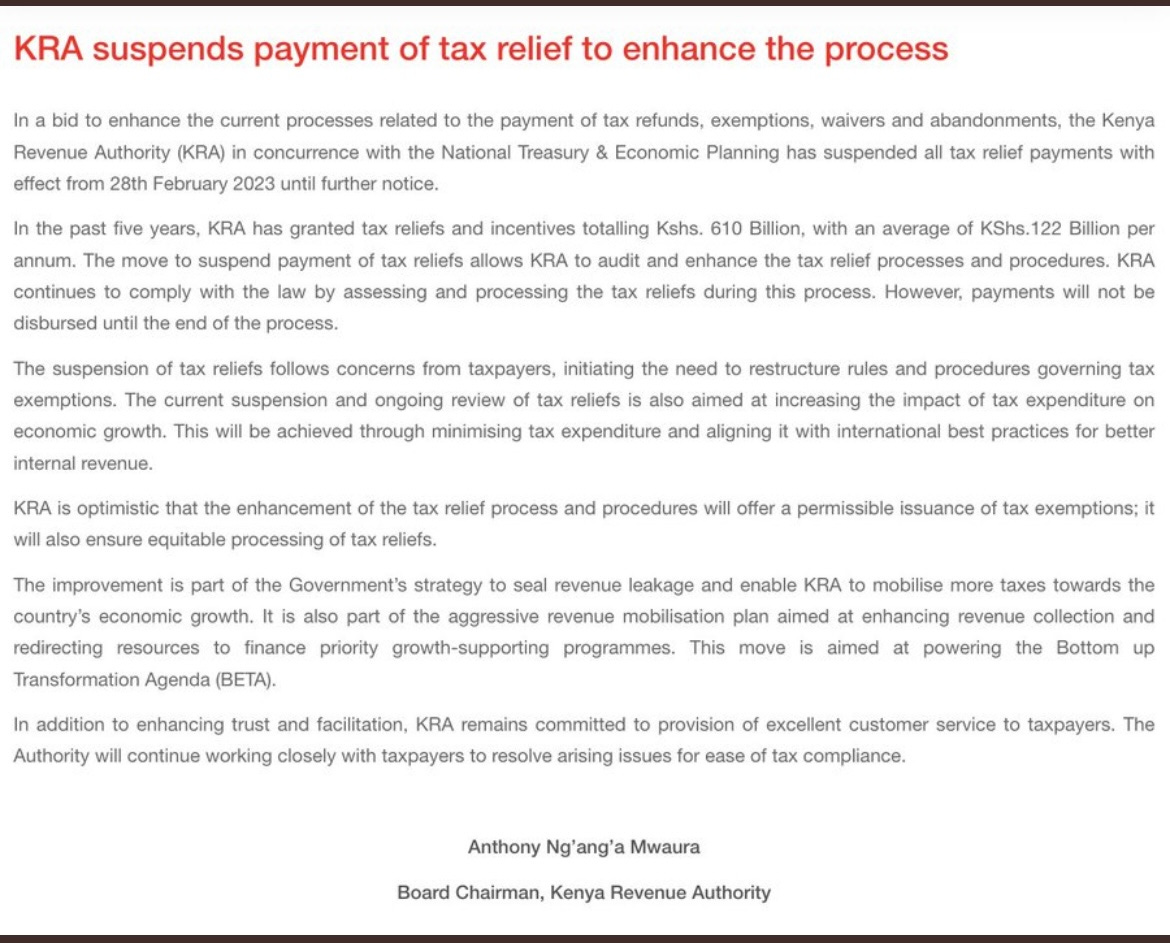

1. What tax reliefs did KRA (Kenya Revenue Authority) suspend?

Earlier last week, the Kenya Revenue Authority issued a notice that it had suspended all tax relief payments until further notice in order to allow an audit and enhancement of the tax relief processes and procedures.

On Wednesday, KRA clarified that it had only suspended tax reliefs in the form of refunds, waiver exemptions, and tax abandonment. This means that tax relief payments on salaries and other charges have not been scrapped.

“KRA acknowledges all the requests from the statement on the suspension of tax reliefs. It is important to note that the statement clarifies on the suspension of provision of reliefs, particularly with reference to refunds, waivers exemptions, and abandonments,” statement by KRA on March 1, 2023

According to KRA, they have granted tax reliefs & incentives of Ksh 610 Billion in the past 5 years.

2. New regulations grant (KRA) access to information on secret bank accounts held by Kenyans in foreign countries.

Last week, treasury Cabinet Secretary, Njuguna Ndung’u, approved the Tax Procedures (Common Reporting Standards) Regulations, 2023. The regulations grant KRA access to information on secret bank accounts held by Kenyans in foreign countries.

Background: The Common Reporting Standards (CRS) framework was introduced in Kenya in July 2021 through the Finance Act 2021, which amended the Tax Procedures Act 2015. The Act required the Treasury Cabinet Secretary to publish regulations that set out how financial entities would identify accounts to report and other relevant information.

Details of the regulations

The Tax Procedures (Common Reporting Standards) Regulations, 2023, provide for its retrospective application as of 1 January 2023.

Its implementation will be instrumental in Kenya’s efforts to mitigate incidences of tax avoidance and tax evasion internationally by Kenyan residents.

The regulations require all banks, trusts, and other financial firms, including local branches of non-resident financial institutions, to report information to the KRA on foreigners’ bank account numbers, names, addresses, residences, Tax Identification Numbers, date and place of birth, and beneficiaries.

According to the Daily Nation Newspaper, KRA will share this information with the 106 signatory countries, including popular tax havens like Switzerland, Panama, Cayman Islands, Bermuda, the British Virgin Islands, Mauritius, Jersey, and Monaco. In return, KRA will receive information on Kenyans holding bank accounts in these jurisdictions

Click here to access detailed insights on the Tax Procedures (Common Reporting Standards) Regulations, 2023

COMPETITION

COMESA Competition Commission forced Jumia to review some of its terms and disclaimers

The COMESA (Common Markets for Eastern and Southern Africa) Competition Commission, compelled Jumia to review clauses and disclaimers that it found to be misleading and/or false. The decision was based on investigations by the ‘watchdog’ into Jumia’s conduct since September 2021.

Clauses and disclaimers found to be false/misleading by the commission

Jumia exempted itself from being a party to the sale agreement to skirt responsibility for products sold by third-party sellers on its platform.

The commission observed that Jumia’s claim - that it was not a party to the transaction on its platform- was false/ misleading. This is because the consumer only deals with Jumia, not the seller. Jumia receives the orders, processes payments, and delivers goods on behalf of the seller

The lack of details concerning the entity that owned Jumia or the legal representatives.

This makes it difficult for consumers or authorities initiating a suit against Jumia from knowing who to serve.

The commission recommended the following:

Jumia should ensure the accuracy of the information on sellers and products posted on its platform.

Where a third-party is involved, the e-commerce site will provide access to a sale agreement between the seller, for the buyer to review and accept the terms before buying the goods.

Jumia to set up conflict resolution channels.

WHAT YOU MIGHT HAVE MISSED

KRA announced an upgrade to the Tax Invoice Management System

The Kenya Revenue Authority (KRA) announced the commencement of phase two of the Tax Invoice Management System (eTIMS). The software will be provided by KRA to taxpayers at no additional cost.

Gap between the CBK dollar rate and banks' trading price widens

On Thursday, the Central Bank of Kenya’s official shilling exchange rate against the dollar was an average of 127.29 units, well below the average of 132.50 quoted by several large banks for retail buyers.

ABSA Kenya names a new CEO

Absa Bank Kenya has named Abdi Mohamed the new chief executive, replacing Jeremy Awori, who exited in October last year. Mr Mohamed, whose appointment is subject to regulatory approval, currently doubles up as Absa Tanzania managing director and acting managing executive for retail and business banking, Africa Regional Operations.

Safaricom partners with 6 banks to battle SIM-Swap fraud

According to Safaricom, the new SIM-Swap-Check Anti-fraud solution is built to restrict withdrawals from suspicious transactions in an effort to curb mobile money fraud. The solution provides banks with an Application Programming Interface (API) through which they can query when a customer’s SIM card was last swapped.

Fingo Africa, First Digital-Only Bank in Kenya, Received CBK Approval

Fingo Africa received regulatory approval from the CBK (Central Bank of Kenya) to roll out its services in Kenya. Fingo joined Y-Combinator (YC) and raised a significant seed capital that valued its business at more than $10 million (Ksh 1 billion during the valuation). This event coincided with the rapid growth of digital banking services.