Happy New Week!

Exim Bank of the USA Issued Kenya a Default Notice

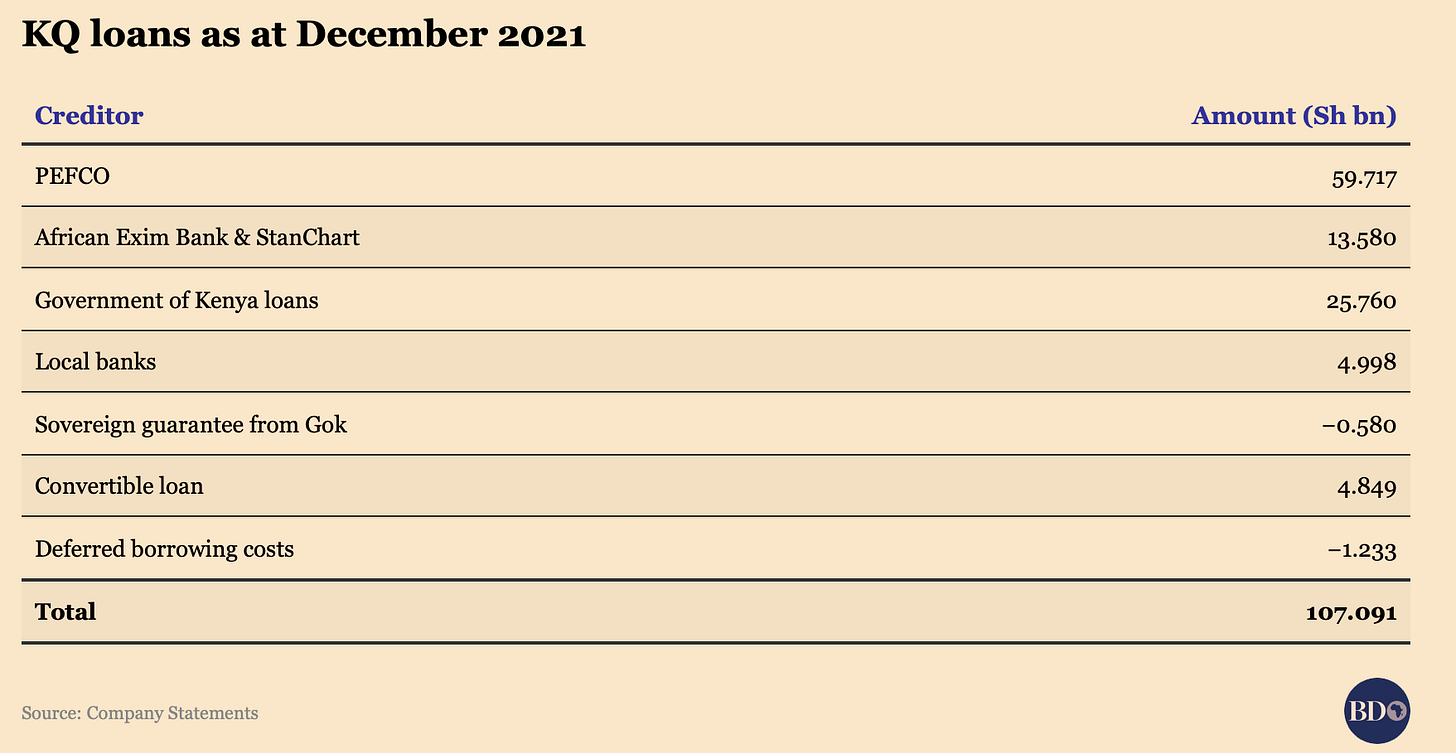

Exim Bank, a US-backed financier, issued the Treasury with a default notice for delayed payment of a Ksh 57.8 billion loan that the government guaranteed Kenya Airways.

details of the loan

Kenya Airways has defaulted on part of its $525 million (Ksh 64.6 billion) loan from the Private Export Funding Corporation (PEFCO) of the USA. The loan was guaranteed by Exim Bank of USA which, in turn, was guaranteed by the Government of Kenya.

The loan was initially a 12-year facility provided by Citi Bank and JP Morgan before PEFCO took it over with Exim Bank and the Kenya government joining in as guarantors.

Chris Kiptoo, the Treasury Principal Secretary, told Parliament that Exim Bank had called on the government of Kenya to pay the loan.

call-up of the loan means that the lender can demand full repayment of the debt on fears of a borrower’s future ability to make payments.

MARKETS

1. The Government is considering floating a new euro bond

In an interview with Reuters, the director of Kenya’s debt management office stated that the Kenyan Government is considering issuing a Eurobond with varying terms to manage next year’s maturity of its $2 billion, 10-year bond.

“The government’s debt-servicing costs have risen in recent years, and the country’s currency has weakened significantly against the dollar over the past three years. To attract different investors and smooth out future maturities, the bond could be structured in two or three tranches, depending on the advice received from bankers” - Director of Treasury’s debt management office Haron Sirima as quoted by Reuters.

Kenya’s public debt stood at 60% of GDP at the end of last year

2. ACORN seeks to venture into apartments by establishing a new REIT

According to its CEO, Acorn Holdings (Student hostels developer) plans to establish a new real estate investment trust (Reit) to venture into the development of apartments for young urban professionals.

2021: The firm raised Ksh 2.1 billion from investors in its first Reit, for the building of student hostels. The Reit had targeted Sh7.5 billion.

Acorn Holdings funds projects with a mix of debt and equity.

Acorn currently has 11 properties with a capacity for 11,013 beds for students.

Chief executive at Acorn, Edward Kirathe, told the Business Daily that the property developer could float the Reit in the next 12 to 18 months, depending on the timings of clearance from the Capital Markets Authority (CMA)

Acorn will have to pick a promoter and a transaction advisor to help in structuring the Reit.

The previous Reit was offered at the Nairobi Securities Exchange under the unquoted securities platform (USP). MERGERS

Engen and Vivo Energy merged their African businesses

On 9th February, Engen and Vivo Energy announced a combination of their respective African businesses to create one of Africa’s largest energy distribution companies.

The details of the value and timeline of completion of the deal were not revealed. However, here are some details of the transaction that were stated in the announcement:

Vivo Energy has agreed to purchase a 74% stake in Engen Limited from PETRONAS International Corporation Ltd at completion.

The merged entity will have 3,900 service stations and 2Billion litres of storage capacity in 27 African countries.

The deal is presently pending regulatory approvals and the fulfillment of preconditions.

According to data from the Energy and Petroleum Regulatory Authority (Epra), Vivo Energy Kenya dominated the fuel market in Kenya during the first half 2022, accounting for 23.83% of all fuel sold. During this period, Vivo Energy Kenya generated revenues of Ksh 114 billion ($924 million), a 30.6% increase from 2021.

The acquisition is timely especially since the local petroleum market is experiencing increased activity, including the recent acquisition of motor oil and lubricants group Valvoline by Saudi Aramco.

Note: It has been approximately 5 years since Vivo Energy Group Plc's takeover of Shell in 2017

MOBILE MONEY

I&M Bank officially waived Bank to M-PESA charges from its digital banking platform

Last week, I&M bank officially waived Bank to M-PESA charges from its digital banking platform.

The Bank stated that the move was informed by consumer insight on the high cost of living and the bank’s need to offer its customers some relief during the tough economic times.

The move will save I&M customers between Ksh 10 and Ksh 65, the range charged by the lender after the Central Bank of Kenya (CBK) announced a re-introduction of charges on transactions between banks and mobile money wallets.

The waiver makes I&M the first lender in Kenya to officially offer zero fees for bank-to-M-Pesa and Airtel Money transactions.

I&M bank stated that it would extend the waiver to T-Kash transactions for Telkom users.

SACCOS

Inter-sacco lending framework to be operational in August

The Cabinet Secretary for Cooperatives and Micro, Small and Medium size businesses, Simon Chelugui, stated that Kenyans should expect an inter-sacco lending framework by August of this year.

“We are calling it Sacco Central and it will be a shared facility, which will help provide core banking and it will enable saccos to borrow from one another. As we speak today, the World Bank came forth and sponsored a study to operationalise this and as we speak, the design is ready and I am just waiting for a presentation on a policy framework to guide the operation” - Mr Chelugui.

Inter-market lending frameworks among lending institutions are critical in addressing potential challenges such as runs, which occur when a lender is unable to meet their immediate liquidity demands owing to shortfalls in cash.

The inter-sacco lending framework is expected to borrow significantly from the banking sector in the design and implementation of this inter-market lending framework.

Banks’ inter-market lending framework

In the inter-bank market, players within Kenya’s commercial banking space extend loans to one another for maturities of predominantly a week or less. Such loans are extended at pricing referred to as the ‘interbank rate.

WHAT YOU MIGHT HAVE MISSED

In the fourth quarter of last year, The National Social Security Fund (NSSF) sold Ksh 837.2 million worth of shares in KCB Group

Disclosures by KCB show that the National Social Security fund disposed of 21.63 million shares in the last quarter of 2022, cutting its ownership of KCB to 8.39% in December from 9.07% at the end of September.

Somaliland Customs Department announced Tax Reduction for Kenyan Miraa

The Somaliland customs department issued a directive that miraa from Ethiopia and Kenya would be taxed equally at $3.78 per kilogram. This directive, which took effect on 23 January, replaced the previous system where Ethiopian traders paid $1.57 per kilogram of miraa while Kenyan traders paid $4.50.

Kenya Revenue Authority extended the deadline for submission of comments on the Draft Excise Duty (Amendment) Regulations, 2023 to 21st February 2023.

Access the Draft regulations here