Goodmorning

Depreciation of Land in Nairobi suburbs

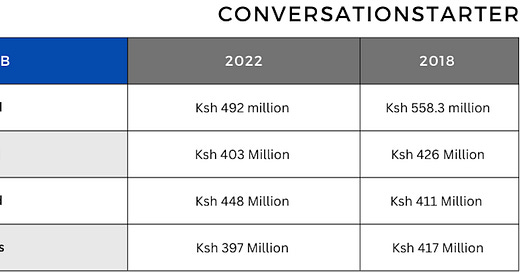

Historical land price data by realtor HassConsult revealed that land prices in Upper Hill, Kilimani, Parklands, Lavington, and Gigiri have declined. The data showed that an acre of land in these suburbs is cheaper today than it was five years ago (2018).

The major market upset has been termed by some analysts as a ‘price correction’.Hass Consult stated that Upper Hill was experiencing an oversupply of commercial office space that had seen developers adopt a “wait-and-see” attitude before committing capital to new projects, while housing developers in the suburbs are waiting for inventory to get sold and vacancy levels to improve before rolling out new units.

why the low demand?

The fall in consumer spending power and caution over investing due to job losses and business closures has affected demand for new houses, leaving developers unable to put up new units.

Land prices per acre

CAPITAL MARKETS

1. Infrastructure bonds dominate the market

Data from the Nairobi Securities Exchange revealed that Investors are buying more infrastructure bonds compared to other treasuries in the secondary market, underlining the attractiveness of the securities whose returns have been higher.

The Nairobi Securities Exchange data shows that the value of infrastructure bonds traded in the four weeks of December 2022 was Ksh 26.42 billion, outpacing the Sh14.81 billion seen in transactions of two, five, 10, 15, 20, 25 and 30-year bonds.

The infrastructure bonds have been traded by a large margin with 1,634 deals compared to 300 for the other bonds over the same period.

2. Half of Nairobi Securities Exchange firms did not pay dividends

Market data showed that 28 of 59 listed companies with ongoing operations did not pay dividends for their latest respective financial years, with some extending their payout drought to years.

The lack of cash distributions at firms like Kenya Airways, HF Group, Home Afrika and WPP Scan group has exposed investors to major losses as their share prices have declined significantly.

The stocks of a few of the companies such as Olympia Capital have registered price gains over the past 12 months.

COMPANIES

1. High Court ordered the liquidation of investment projects owned by Cytonn Real Estate

The High Court ordered the liquidation of investment projects owned by Cytonn Real Estate, allowing the sale of its properties in an effort to recover more than Ksh 14 billion the firm owes 4,000 investors.

Justice Alfred Mabeya also ordered the preservation of the company’s assets and housing projects identified as “the Alma, Applewood/Miotoni, Riverrun, Ridge and Taraji” until the liquidation is concluded.

The court noted that more than 3,000 members of the public invested in excess of Ksh 11 billion through Cytonn High Yield Solutions (CHYS) and 886 others invested more than Sh4 billion in the Cytonn Real Estate Project Notes (CPN).

“The court must be sensitive and alive to the plight of over 3,000 members of the public who sank their over Sh11 billion and 886 others whose over Sh4 billion was sunk into these projects and therefore lean towards a lesser evil, which is to preserve those assets for the time being,” - Justice Mabeya

2. Elon Musk's Starlink (a high-speed internet service) to be launched in Kenya

Satellite Internet firm Starlink announced it will launch in Kenya in the second quarter of this year, posing competition to other players in the industry including Safaricom and Zuku.

The company announced that it was waiting for regulatory approval.

Starlink uses satellites aimed at providing broadband Internet across the globe, much in the manner through which the global positioning system (GPS) provides location data to cell phones around the planet.

Unlike GPS, it requires thousands of satellites for service to work without drops in coverage.

Kenyans, can order and deposit an amount of ksh 12,260 ($99) which is fully refundable to get the service if approved.TAX

Kenyan betting companies to pay taxes daily by 1am.

Betting companies must now pay taxes daily by 1am. This is a result of changes that have seen the Kenya Revenue Authority plug into betting platforms to allow real-time computation of taxes.

Background

Recently, the Kenya Revenue Authority (KRA) completed a pilot program that allowed it to interlink its tax system with the betting sector. This enables it to track the 15% tax on betting, gaming, and lottery as well as the 20% withholding tax on winnings collected from punters every day.

KRA has linked its systems with those of around seven sports gaming firms. The in what is aimed at sealing the loopholes of tax leakages that were exacerbated by the 30-day time lag.

All the tax heads are normally paid after 30 days. However, the new system will seal the loopholes of tax leakages that were exacerbated by the 30-day time lag.

SportPesa, one of the sports gaming companies that piloted the interlink, confirmed that they were already paying taxes.BANKING

1. Centum’s plan to sell Sidian Bank to Access Bank collapsed

Centum Investments Plc announced that it will not sell the bank to Nigerian giant lender, Access Bank Plc.

In a public notice on January 12, Centum said the deal valued at Ksh4.3 billion ($34.95 million) fell through after the parties failed to fulfill the transaction conditions within the timelines prescribed in the Share Purchase Agreement (SPA).

Centum, which is listed on the Nairobi Securities Exchange, had opted to sell off its entire stake (83.4 percent) in Sidian Bank (formerly K-Rep Bank) after the third-tier lender failed to generate returns for seven years (2014-2021).

2. The high court temporarily suspended Bank — M-Pesa charges

The High Court ordered Safaricom and the Central Bank of Kenya to suspend the reintroduction of bank-to-MPesa charges pending the determination of a suit involving financial consumer rights.

The interim order was issued by High Court judge Mugure Thande in a petition filed by a Nairobi resident Mr Moses Wafula who claims that the charges should not be passed to consumers.

The order effectively stops the reintroduction of charges between mobile money wallets and bank transactions as advanced by the CBK through a press release issued on December 6, 2022.

WHAT YOU MIGHT HAVE MISSED

Java House is on sale by Actis, a UK-based Private Equity fund

Restaurant chain Java House has been put on sale by UK-based private equity fund Actis for an undisclosed value expected to run into billions of shillings, three years after it was acquired from Dubai-based Abraaj Group.

Sources familiar with the transaction said Actis is looking for a buyer for its 100% stake in Java House in what could be another change of ownership at Kenya’s biggest coffee chain.

The search for a buyer comes months after Actis inked a deal to buy hotel properties in Kenya and Tanzania and has been on since last year, multiple sources said.

National Treasury Cabinet secretary warned Kenyans of tough time ahead

National Treasury Cabinet Secretary Njuguna Ndung’u advised Kenyans to brace themselves for tough economic times, saying that the nation’s financial crisis is reaching unfathomable heights.

Speaking during the opening of the public sector hearings for the FY 2023/24 and the medium-term budget, Ndung’u demanded that the ministries should implement austerity measures, including the suspension of any new construction initiatives, to be able to weather through the crisis.

Fuel Pump prices for Jan/Feb 2023

The price for Super Petrol, Diesel & Kerosene remains unchanged in this month’s review.

The Landed cost: Super Petrol is down by 6.2%, Diesel is down by 11.1%, and Kerosene is down by 4.1%